Nonresident aliens (NRAs) generally are not taxed on U.S.-source capital gains, such as profits from portfolio investments in stocks or cryptocurrency. An NRA sells Apple stock in a U.S. brokerage account at a gain? Not taxable. They exit an appreciated position in a U.S.-based crypto investment? Still not taxable. This is one of the few advantages of NRA status.

However, two provisions of the Internal Revenue Code can erase that advantage entirely: the Substantial Presence Test and the 183-day rule. For NRAs with significant U.S. ties, these are not hypothetical concerns, they’re planning realities that require proactive tax strategy. This article explains how Qualified Opportunity Fund (QOF) investments can help NRAs navigate both provisions while preserving valuable tax benefits.

The Substantial Presence Test: When NRA Status Ends

The Substantial Presence Test determines whether a nonresident individual becomes a U.S. resident for tax purposes. For many NRAs, it’s not a question of if they’ll trigger the test, but when.

The SPT uses a three-year weighted formula:

- All days present in the current year, plus

- ⅓ of days present in the prior year, plus

- ⅙ of days present in the year before that

If the total equals 183 days or more, and the individual was present at least 31 days in the current year, they are treated as a U.S. resident for tax purposes.

This creates real planning challenges for NRAs who divide time between the United States and their home country or who have extended business stays or family visits. Once someone becomes a resident alien under the SPT, everything changes; they are taxed on worldwide income, including all capital gains regardless of source. For those with significant international portfolios, this can cause a dramatic increase in U.S. tax exposure.

Certain visa holders—such as foreign government employees, teachers, or students—may qualify as “exempt individuals” under the SPT. However, these exemptions do not protect against the separate 183-day rule.

The 183-Day Rule: A 30% Capital Gains Tax Trap

Non-resident aliens often assume they’re shielded from U.S. income tax on capital gains if their visa classifies them as an “exempt individual” under the SPT. Yet a little-known rule can still impose tax: the 183-day rule.

If an NRA is physically present in the United States for 183 days or more during any tax year, their otherwise non-effectively connected (non-ECI) and non-real-property (non-FIRPTA) U.S.-source capital gains for that year become subject to a flat 30% tax. These gains can include sales of U.S. stocks, artwork, or cryptocurrency held through U.S. custodians.

This levy applies without regard to holding period; there are no preferential long-term capital gains rates (0%, 15%, or 20%) that are available to residents. Nor does the typical NRA exemption apply when U.S. presence reaches 183 days. In effect, the rule can transform otherwise tax-free gains into a 30% haircut, purely due to days spent in the United States.

How Qualified Opportunity Funds Provide Strategic Relief

This is where Qualified Opportunity Funds (QOFs) offer a powerful tax planning tool. A QOF investment allows an NRA to defer capital gains that would otherwise be taxable under either the SPT or the 183-day rule—shifting when and how the gain is recognized and therefore which tax rules apply.

Under current law, if a client realizes they’ll exceed 183 days in a given year or trigger the SPT, they can roll eligible capital gains into a QOF within 180 days of the sale. The gain is then deferred until the earlier of either the date the QOF investment is sold or December 31, 2026. Because the gain is not recognized in the current year, it isn’t subject to immediate taxation.

This deferral creates meaningful flexibility. In a later year, the investor might spend fewer than 183 days in the United States, allowing the deferred gain to escape U.S. taxation entirely. Or, if they intentionally become a resident alien, the deferred gain may be taxed at preferential long-term capital gains rates (0%, 15%, or 20%) rather than the flat 30%.

Even better, if the investor holds the QOF interest for at least 10 years, all appreciation of the QOF itself is completely excluded from tax, with the basis stepped up to fair market value on sale. For NRAs contemplating future residency or citizenship, this can mean up to 30 years of Roth IRA-like tax-free compound growth.

A Practical Example: Timing Income Recognition

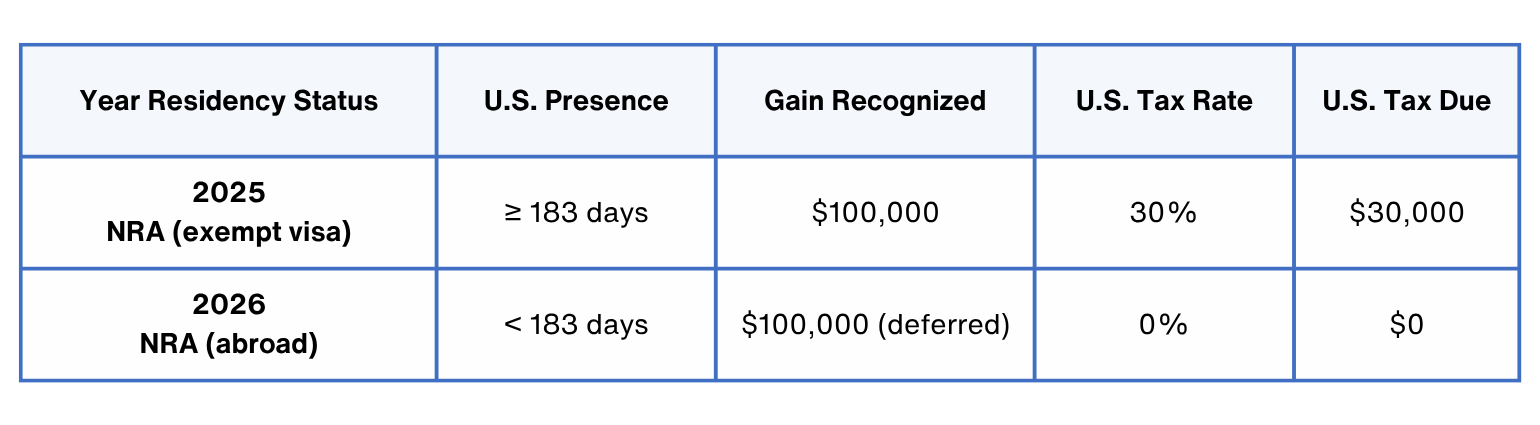

Consider a nonresident alien temporarily in the United States under an exempt-individual visa who sells U.S. stock in 2025, realizing a $100,000 gain. Although exempt from the SPT, the individual remains in the country long enough to trigger the 183-day rule, making the gain U.S.-source and subject to a flat 30% tax—a $30,000 liability.

If instead the individual elects to defer the gain by investing in a QOF within 180 days, the gain isn’t recognized until the earlier of (1) the sale of the QOF or (2) December 31, 2026. By that time, the investor has left the U.S. and spends fewer than 183 days in the country. Consequently, the deferred gain recognized in 2026 isn’t subject to U.S. tax.

Result: By deferring recognition through a QOF, the investor reduces U.S. tax liability from $30,000 to $0—purely through timing and presence management.

This example highlights how QOF deferral can turn a taxable gain into a non-taxable one without changing the underlying investment economics.

Enhanced Incentives Beginning in 2027

- Deferred gains are recognized upon the earlier of the QOF’s sale or five years from purchase.

- 10% of the deferred gain is permanently excluded if the investment is held for the full five years.

A Bridge Strategy for Residency Transitions

With the passage of the One Big Beautiful Bill Act (OBBBA) in July 2025, the Opportunity Zone program has been made permanent, with enhanced incentives beginning January 1, 2027.

Under the new rules:

- Deferred gains are recognized upon the earlier of the QOF’s sale or five years from purchase.

- 10% of the deferred gain is permanently excluded if the investment is held for the full five years.

For investments made in 2025 or 2026, the legacy rules still apply, with deferral until December 31, 2026. If a QOF is sold in late 2026, the gain is treated as recognized and, crucially, may be re-deferred by reinvesting into a new QOF in 2027 as long as the re-investment is made within 180 days.

This “re-deferral” strategy bridges a current capital gain to the enhanced 2027 incentives. For example, if an NRA investing in a QOF in 2025 could sell their QOF in late 2026 and have 180 days to reinvest in a new 2027 QOF to re-defer the tax. If the new QOF is purchased on January 1, 2027 or later, they would qualify for the enhanced provisions of the new OBBBA rules.

Conclusion

For NRAs exposed to the Substantial Presence Test or the 183-day rule, the ability of QOFs to defer and then re-defer capital gain recognition is a substantial advantage. The deferred gain retains its original source and character, but the ultimate tax outcome depends on the investor’s status when recognition occurs.

With careful planning, this can mean shifting from a 30% flat tax to zero, while also securing long-term tax-free growth on the QOF investment itself. For globally mobile investors and their advisors, QOFs remain a uniquely flexible tool for navigating U.S. residency transitions and optimizing tax outcomes for cross-border investors.

About the Author

Michael Kelley

His publications appear regularly in Thomson Reuters journals, including Practical Tax Strategies, Real Estate Taxation, and Estate Planning, as well as The CPA Journal, Thomson Reuters’ Checkpoint and Westlaw databases, and Kiplinger’s Advisor Intel column. He has also trained over 10,000 CPAs and enrolled agents through continuing education courses focused on Opportunity Zone tax planning strategies.

Read more about the author in his biography.

Park View OZ: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth for 30 years.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

About the Author

Michael Kelley

His publications appear regularly in Thomson Reuters journals, including Practical Tax Strategies, Real Estate Taxation, and Estate Planning, as well as The CPA Journal, Thomson Reuters’ Checkpoint and Westlaw databases, and Kiplinger’s Advisor Intel column. He has also trained over 10,000 CPAs and enrolled agents through continuing education courses focused on Opportunity Zone tax planning strategies.

Read more about the author in his biography.

Materials provided by Park View OZ or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.