The opportunity zone program encourages investors with a capital gains liability to make long-term investments in low-income communities in need of capital.

The Opportunity Zone legislation was passed as part of the Tax Cuts and Jobs Act (TCJA) in December of 2017.

OZs were born as a rare bipartisan provision and late addition to the TCJA. A capital gains liability can be deferred by reinvesting the capital gain portion of your sales proceeds (not including principal) in a qualified opportunity fund (QOF) within 180 days of realizing the gain. There is no dollar limit on how much gain can be deferred.

There are more than 8700 Opportunity Zones through out the United States and QOFs are required to invest at least 90% of their assets into qualifying assets within these communities.

For a comprehensive view of Opportunity Zone tracts and state maps, refer to our Map of Opportunity Zones page.

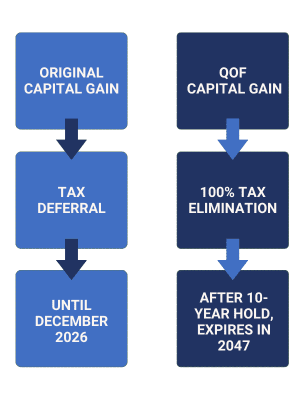

1. A capital gains liability can be deferred until you sell the QOF or December 31, 2026, whichever comes first.

2. After holding the QOF for 10 years the tax liability from any capital gain on the QOF can be completely eliminated. This benefit lasts until the QOF is sold or 2047, whichever comes first.

The first benefit, the deferral, is designed to mitigate the pain of realizing the original capital gain.

It is the second benefit, however, that has the most potential to affect after-tax returns in the long run. Tax-free compound growth can be a powerful wealth creation tool. The Opportunity Zone incentives are designed to reward qualifying investments that are economically successful and long-term.

The IRS has published an excellent and fairly extensive FAQ page for opportunity zones. They address more than 50 of the most commonly asked OZ questions so it can be a great reference for OZ investors. Click here to see the IRS’ most common questions and answers about investing in Opportunity Zones.

One Beacon Street, 32nd Floor

Boston, MA 02108

Monday – Friday, 9:00 AM – 5:00 PM EST

© 2024 All Rights Reserved.