Unlock Roth-Like Tax-Free Growth Without Annual Contribution Limits

Unlimited Contribution Potential

Ever wish you could put more tax-free dollars to work inside your Roth IRA? Tax-free compound growth is one of the greatest drivers of long-term wealth, and is often referred to as “the eighth wonder of the investing world.” The key is to stay focused on the long term and invest as much as possible, as early as you can.

Because Roth accounts offer such valuable long-term tax benefits, the government restricts income and annual contribution limits. However, the newly enhanced OZ 2.0 legislation now offers a powerful path to tax-free compound growth, free from contribution limits or income restrictions: Qualified Opportunity Funds (QOFs).

How QOFs Work

Once an investor realizes a capital gain, they have 180 days to invest up to the amount of the gain into a QOF. There is no dollar limit on how much gain can be deferred. Staying invested for at least 10 years eliminates the capital gains tax on QOF appreciation. QOFs also offer an additional deferral benefit and no penalties for early withdrawal.

Although only proceeds from recent capital gains can qualify for tax deferral and possible elimination incentives, Park View OZ is a mixed fund that allows you to invest any type of capital you choose.

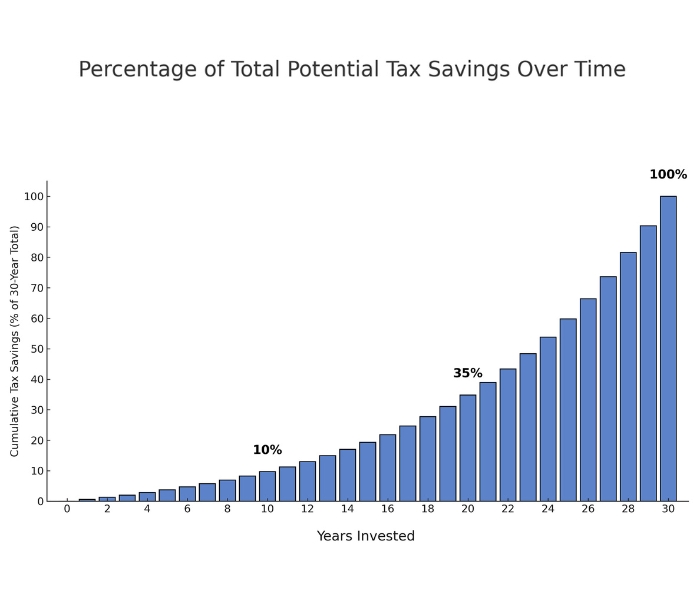

While the enhanced OZ 2.0 benefits are not yet active, investors can still position themselves now. Current QOF benefits remain available, and a bridge strategy helps investors keep their gains eligible for OZ incentives, avoiding the “dead zone” and ensuring those gains can transition into the new benefits once they begin. These include a 5-year deferral, a 10% gain elimination, and the potential for up to 30 years of tax-free growth.

Why Park View OZ

As a publicly traded stock, our investors benefit in several ways:

- No investor accreditation requirements: open to all investors

- No investment minimums: purchase as little as one share on the open market

- No complicated partnership (K-1) tax forms: simple 1099-DIV reporting

- No capital lockup or forced liquidation: shares are freely tradeable

- Low industry fees: 0.75% management, 0% carried interest

Our fund is structured to deliver the full benefits of Opportunity Zone investing by giving our investors the control they need to maximize these powerful incentives.

Already maxed out your annual Roth IRA contribution? Enjoy tax-free growth without investment maximums or income restrictions with Park View OZ.

These pages are prepared for informational purposes only and are not offered as legal, tax, or investment advice. All content provided is of a general nature and does not address the particular circumstance of any particular individual or entity. We encourage you to seek guidance regarding your individual financial needs from legal, tax or investment professionals. Investments, including our shares of stock, have inherent risks including the risk of principal loss.