Every Capital Gain is an Opportunity for Tax Savings.

Qualified Opportunity Funds (QOFs) in Brief

Incorporate more Roth IRA-like tax-free growth into your portfolio. Qualified opportunity fund tax incentives offer the potential for more than two decades of Roth IRA-like tax-free compound growth without annual contribution caps. QOFs also offer a tax deferral benefit without early withdrawal penalties.

Eligibility for QOF tax incentives is determined solely by the amount of capital gains the taxpayer has recognized in the last 180 days. QOF investments can grow tax-free until the legislation’s benefit sunsets in 2047. This gives investors with capital gains the advantage of contributing unlimited large amounts of capital to work in tax-advantaged contributions with speed that is not possible with Roth IRAs.

How This Strategy Is Enabled by Park View OZ REIT

The overwhelming majority of QOFs are private partnerships. They typically require a 10-year lock-up of the investor’s capital followed by a planned liquidation of the fund shortly after the 10-year hold is achieved. In our opinion, this “one size fits all” holding period does not serve the investor well. We feel it is important that our investors are able to tailor their holding period. This gives them the opportunity to implement a myriad of QOF tax strategies that would not otherwise be possible. You can learn more about QOF tax strategies by reading our document Maximizing Tax-Efficient OZ Strategies. Having our stock public also has the added benefit of making QOF tax incentives convenient to access by eliminating partnership tax forms (K-1s), investor accreditation requirements, and high investment minimums.

Understanding the QOF Tax Elimination Incentive

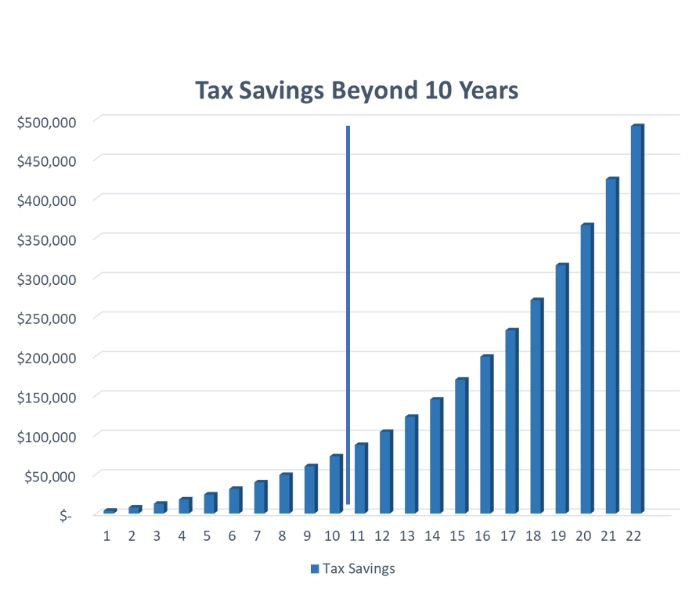

Once the investor has owned the QOF for 10 years they can elect to step up their cost basis to 100% of the sale price, eliminating any capital gains liability and the 3.8% net investment income tax (NIIT). This tax elimination is often thought of as a 10-year benefit, but that is just the beginning because the benefit does not expire until the investor exits the QOF or 2047, whichever comes first. Compound growth curves accelerate in the outer years, which is certainly true for QOFs. Based on typical market returns and the current sunset date of 2047, approximately 80% of the potential tax benefits from an investment made today are realized after the 10-year holding period.

This graph illustrates the potential to eliminate tax liability through a QOF investment. Most investors think of the tax elimination as a 10-year benefit but it actually lasts until you exit the QOF or 2047, whichever comes first. The graph shows that roughly 80% of potential tax savings occur after the 10-year hold.

Roth IRAs Retirement Planning Basics

Similar to QOFs, Roth IRAs offer tax-free compound growth. Many investors recognize the power of combining long-term growth with tax-free status. If you let this duo run long enough, it can be life-changing. For this reason, compound tax-free growth is sometimes referred to as “the eighth wonder of the financial world.”

However, the U.S. Treasury is foregoing significant revenues by offering this powerful incentive. This is an effective way to entice taxpayers to save, but it also makes balancing the budget a challenge. As a result, the Treasury reduces its exposure to this wealth transfer by limiting contributions to Roth IRA accounts through both income restrictions and annual contribution caps.

Differences and Similarities between Roth IRAs and QOFs

QOFs and Roth IRAs function very differently but they share the ability to deliver tax-free growth. One difference is that Roth IRA contributions are after-tax money, while QOFs defer the taxes owed until December 31, 2026. We believe there is a high probability that the deferral period will be extended by Congress this fall. The deferral period was originally nine years when QOF legislation was passed into law as part of the Tax Cuts and Jobs Act of 2017.

Roth IRAs can grow tax-free for the remainder of the taxpayer’s life but a QOF’s tax elimination benefit will expire in 2047 unless Congress extends the date. QOFs are ideal for intergenerational wealth building because the beneficiary “steps into the shoes” of the benefactor in all respects, while intergenerational beneficiaries of Roth IRAs need to liquidate them within 10 years of the benefactor’s death. Roth IRAs motivate investors to save by offering the benefit of tax elimination, but they also impose a 10% penalty for early withdrawals. In contrast, QOFs use only an incentive, allowing investors to exit at any time without facing a penalty. The biggest similarity is that both accounts can grow tax-free if minimum requirements are met. For QOFs, it is a 10-year hold period and for Roth IRAs, it is a 5-year hold and you have to be at least 59 ½ years old.

Determining Qualifying Investments in Roth IRAs and QOFs

There are several differences between the two programs in determining eligible capital. To make a qualifying investment in the tax year 2025 Roth IRAs have maximum annual contribution limits of $7,000 for those under age 50 and $8,000 for those over age 50. Eligibility for a Roth IRA contribution is also restricted by income limitations. The taxpayer is eligible to make a full contribution if their modified adjusted growth income (MAGI) is less than $150,000 for a single filer. The contribution limit decreases rapidly until single filers with a MAGI of $165,000 or more are completely ineligible. Married couples filing jointly can fully contribute to a Roth IRA if their MAGI is less than $236,000. The contribution limit then phases out until $246,000.

QOFs do not have annual contribution limits or income restrictions. Instead, when a taxpayer realizes a capital gain, they are eligible to make a qualifying QOF investment up to the dollar amount of the gain within 180 days. Only the gains portion of the sale proceeds is eligible. Any sale proceeds deemed to be principal do not need to be invested and are not eligible for QOF benefits. There is no dollar limit on how much gain can become tax-advantaged in a QOF.

An Example of QOF Tax Savings

An investor re-invests a recent $1,000,000 capital gain into a QOF. Once the 10-year holding period is achieved, the investor is eligible to exit the QOF without owing any capital gains tax or the 3.8% net investment income tax (NIIT) on the fund’s appreciation. If the investment averages 11% annual growth after 10 years the investment would be worth $2,839,000 and the capital gain would be $1,839,000 (calculated as $2,839,000 – $1,000,000), resulting in a tax savings of $439,521 (1,839,000 x (20%+3.9%). Saving over $400,000 in taxes is impressive, but when considering the tax-free compounding effect over the full 22 years until the QOF incentives expire in 2047, the investment could grow to an astounding $9,934,000, resulting in a tax savings of $2,136,000 (calculated as $8,939,000 x 23.9%). We use marginal tax rates for simplicity and illustration.

The important takeaway from this example is that it pays to keep tax-free compound growth building as long as possible. Roughly 80% of the QOF’s tax elimination benefit comes after year ten.

If Congress extends the benefit to the original 30-year term, the investment could grow tax-free until 2055. Using the same assumptions the investment would reach $22,800,000 and the tax savings would grow to more than $5,000,000 (21,800,000 x 23.8% = 5,188,400).

Summary

Long-duration tax-free compound growth is a great way to build wealth. Qualified Opportunity Funds (QOFs) give taxpayers a greater opportunity to get more money into tax-advantaged status than Roth IRA contributions can. Because we have publicly traded stock at Park View OZ REIT, our investors control their holding period which enables them to fully utilize this powerful tax incentive. We do not mandate required liquidations after the 10-year hold like nearly all QOFs do, which enables continuous tax-free compound growth. As the late Charlie Mungar liked to say: “The first rule of compounding: Never interrupt it unnecessarily.”

Discover how Park View OZ delivers Roth IRA–like tax-free growth without income limits or contribution caps. Read our Fund Overview the full overview to learn more.

Park View OZ REIT: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ REIT is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth for 30 years.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.

I’m really impressed with your writing skills as neatly as with the layout to your

weblog. Is this a paid topic or did you customize it

yourself? Either way stay up the excellent quality writing, it’s uncommon to see a nice weblog like this one nowadays.

HeyGen!