Having publicly traded shares gives Park View OZ REIT (PVOZ) investors the power to control their own holding period, unlocking tax-efficient financial planning strategies unavailable from most QOF investments. Here are some examples:

1. Achieving tax-free compound growth.

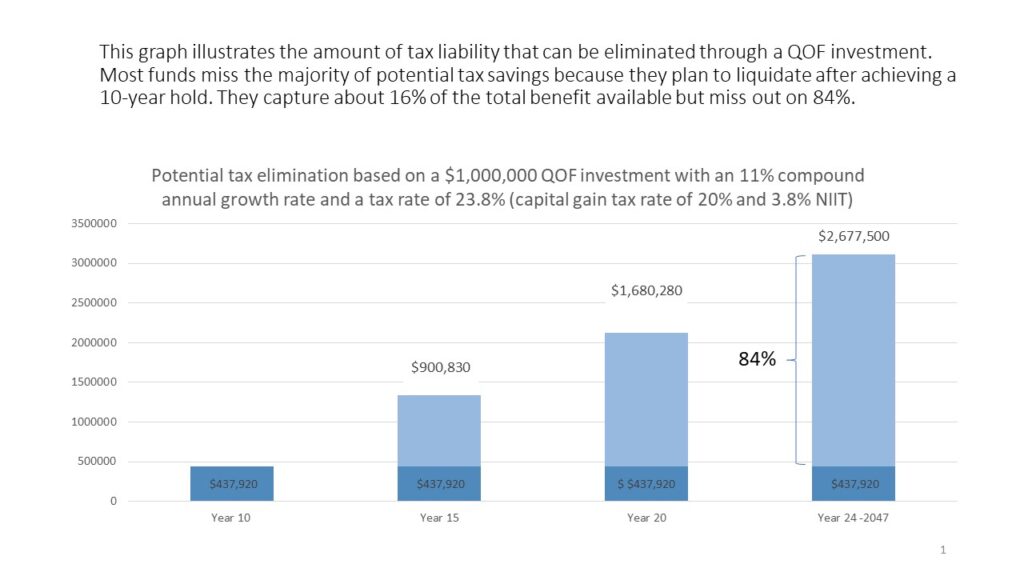

The biggest tax benefit offered by a QOF investment is the potential for tax-free compound growth, aka “the eighth wonder of the investing world” beyond ten years. Once an investor achieves a 10-year hold in the QOF they can eliminate any capital gain liability. This benefit is often thought of as a 10-year benefit but does not expire until 2047. Compound growth curves accelerate in the outer years, and this is certainly true for QOFs. Using typical market returns, more than 80% of tax benefits are derived after year 10. Unfortunately, many QOFs have planned liquidations shortly after the tenth year, ending the tax-free compound growth prematurely. We give our investors the ability to stay invested, keeping tax-free growth compounding for decades. The option to keep tax-free compound growth rolling can be very beneficial (see graph.)

2. Better matching of gains and losses.

QOFs can provide investors participating in volatile sectors with a great option for mitigating taxes. When an investor has a capital gain, whether short-term or long-term, they can choose to pay the tax, or they may want to defer the tax by using QOF tax incentives. If they defer the gain and then suffer a capital loss in any future year during the deferral period they can trigger all or a portion of their deferred gain by selling the appropriate portion of their QOF. This realization of a deferred tax liability in a year with a tax loss delivers tax efficiency while keeping capital working for you longer. Learn more in our Fund Overview.

3. Lowering tax rates on 1231 gains.

Gains and losses from business property (1231 gains held for more than a year) are taxed asymmetrically. Gains are taxed at capital gains rates, but losses are taken at higher ordinary income rates. This is a very taxpayer-friendly rule, but there is a “5-year look back period.” If you took a 1231 loss four years ago and this year you have a 1231 gain, the tax rate for the gain will be at ordinary income tax rates to offset the loss within the “look back” window. By investing in Park View OZ REIT’s shares you can potentially defer the 1231 gains realization date beyond the “5-year look back, reducing the potential applicable tax rate from 37% to the capital gains rate of 20%, all while keeping your money working for you longer.”

Park View OZ REIT was designed to give investors and investment advisors the accessibility and holding period flexibility they need to create superior tax-efficient strategies.

For a more extensive list of strategies, you can reference a recent article by our CEO, Michael Kelley, published in Thomson Reuters August 2023 issue of Practical Tax Strategies, A Dozen Ways to Enhance Tax-Efficient Financial Plans with Qualified Opportunity Funds.

Let your money grow tax efficiently. Invest in freely traded stock on the open market (trading symbol: PVOZ) or by purchasing shares in minutes by filling out and signing our electronic subscription agreement.

Our electronic subscription agreement allows you to buy PVOZ shares at our net asset value of $100 each. Open market shares may be offered at higher or lower prices. Also, because our shareholder base gravitates toward long-term holding periods, PVOZ shares can be difficult to acquire on the open market resulting in illiquidity and price volatility. Please consider using the subscription agreement when buying our shares or using price limit orders if transacting in the open market. The shares are identical regardless of how they are acquired.

Before investing we encourage you to read our offering document which can be accessed by clicking here.

Park View OZ REIT: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ REIT is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth through 2047.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

Your writing is a true testament to your expertise and dedication to your craft. I’m continually impressed by the depth of your knowledge and the clarity of your explanations. Keep up the phenomenal work!