Investing in a Qualified Opportunity Fund (QOF) offers both short-term and long-term tax benefits.

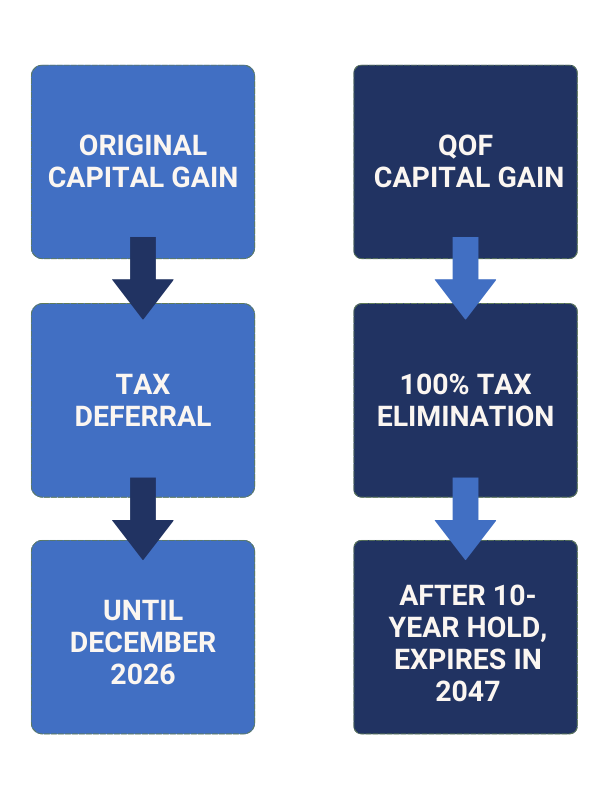

The short-term benefit is a deferral of your original capital gains taxes. This benefit will last until December 31, 2026, or the date when you sell your QOF investment, whichever comes first. By making an eligible investment in a QOF the investor is deferring their capital gain realization date. So even a short-term hold at year-end could defer a capital gains liability to a new tax year.

The long-term benefit kicks in once you have held your QOF investment for 10 years. You can step up your cost basis in the QOF to 100% of the sale price, eliminating all capital gains liability. This benefit lasts until the end of 2047. Importantly, the step up in basis also eliminates the 3.8% Net Investment Income Tax (NIIT) and depreciation recapture which has an even higher marginal tax rate of 25% versus 20% for capital gains.

Both of these benefits can be deployed to significantly increase a portfolio’s tax efficiency, but it is the ability to eliminate capital gains, NIIT, and depreciation recapture over decades that can exponentially accelerate wealth creation.

Typically, assuming a 10-year hold and an annual market return of 7% or 8%, the QOF will increase after-tax equivalent returns by 3% to 5%. Even at the low end, this allows investors a 40% (3%/7.5%=40%) higher return. The compounding effect for long-term QOF holders can truly be tax-free nirvana.

Interested in learning more about the benefits of Opportunity Zone investing? View our Opportunity Zone 101 page for more information.

Park View OZ REIT: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ REIT is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth through 2047.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.