Providing a Bridge Over the OZ Funding Dead Zone

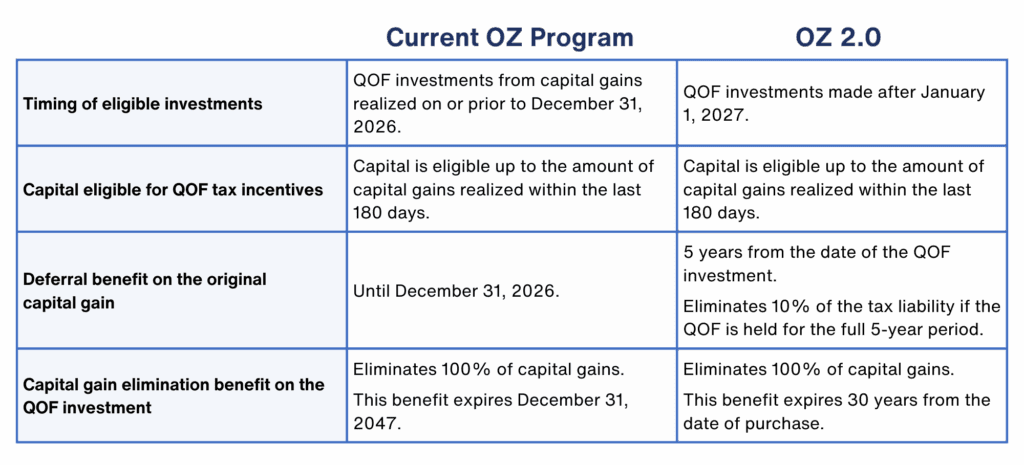

The new permanent opportunity zone (OZ) legislation offers enhanced tax incentives, but only for investments made into qualified opportunity funds on or after January 1, 2027. Under QOF rules, capital gains need to be invested into a QOF within 180 days of the gain being realized. This means that gains taken before July of 2026 will, in most cases, not be eligible by the time the enhanced tax incentives roll out in 2027. Many observers fear that this will unintentionally create what the law firm Baker Tilly describes as a “Dead Zone” for investments in OZ communities [1]. We agree that it is highly likely that many investors will wait for the enhanced benefits to become available. This situation will frustrate taxpayers and result in capital investment being cut off to the communities that need it most. This is clearly counter to the purpose and intent of the legislation.

We believe a solution to bridge this investment gap is provided by the already existing regulatory framework. In our opinion, the final OZ regulations make it clear that a capital gain deferred by an initial QOF investment, once sold, can be treated as a newly realized capital gain. This includes a fresh 180-day window to continue the deferral by investing in a new or the same QOF [2]. As the only QOF with publicly traded stock, we feel Park View OZ REIT is uniquely positioned to act as a solution to keep investors’ capital flowing into opportunity zone communities.

This mechanism has the potential to keep investors from moving to the sidelines during an unintentional dead zone period. Here are a few examples highlighting how this strategy could work:

- A taxpayer with a capital gain in 2025 invests in a QOF now, deferring the capital gain realization until they sell the QOF in November of 2026. They would then have a new 180-day window to make a QOF investment to continue the deferral. Most of their investment window would fall after December 31, 2026, making them eligible for the enhanced OZ tax incentives.

- The same taxpayer again invests a 2025 capital gain, but this time holds their QOF investment until March 1, 2027. Their deferral period ends on December 31, 2026, and the QOF re-investment window closes 180 days from that date. However, it does not open until they sell the QOF position on March 1st. The taxpayer cannot have multiple QOF positions originating from the same capital gain at the same time.

- Finally, the taxpayer may decide to stay invested in the original QOF, enabling them to eliminate 100% of any QOF capital gains sooner, which would be 10 years from the date of the QOF investment. The elimination benefit would remain available through 2047. The deferral period would end on December 31, 2026, and the tax would be due in the spring of 2027.

One of the strengths of the bridge strategy is that it keeps taxpayers’ options open. This allows them to potentially make more informed decisions as 2027 approaches.

Investors need to be aware that although it may be an attractive move for some, there is no free lunch.

- The 10-year clock for complete elimination of any capital gain on the QOF resets to zero each time they reinvest in a new QOF, so they will need to stay invested in opportunity zones for a timeline over the normal 10 years.

- Communities that qualify as opportunity zones under the new QOF regulations will have stricter eligibility standards, which could increase the riskiness of the investment.

- Making a short-term QOF investment exposes investors to the risks of price volatility.

- The new opportunity zone legislation is brand new, so there is no case law or other signals from the IRS indicating that they agree or disagree with our interpretation of the regulations. We could have better clarity by the time we are closing in on the transition to the enhanced incentives in 2027.

Here are comments on the final opportunity zone regulations by the law firm of Lowenstein Sandler:

Can a taxpayer reinvest returns from a QOF into another QOF?

Yes. The Proposed Regulations provided that if a taxpayer disposed of the entire QOF interest investment with respect to a Deferred Gain, the taxpayer could make another QOF investment and effectively “re-defer” the Deferred Gain. In a taxpayer-friendly revision of the Proposed Regulations, the Final Regulations provide that even if a taxpayer disposes of less than its entire investment in a QOF, the resulting gain can be eligible for re-deferral. The 180-day reinvestment period begins on the date the QOF investment is disposed of (rather than the date of the original sale or exchange that gave rise to the eligible gain to which the inclusion event relates). Notably, the taxpayer’s holding period in the new QOF investment for purposes of the basis step-up and 10-year benefits (both such benefits discussed below) begins on the date of the reinvestment into the new QOF. [3]

Conclusion

The “Dead Zone” problem is real, but it doesn’t have to be inevitable. We believe the regulatory framework already provides a pathway for investors to bridge the gap between today’s opportunity zone incentives and the enhanced benefits that will become available in 2027. While this strategy comes with inherent risks, it could help maintain capital flows to opportunity zone communities, help investors build tax-efficient financial plans, and allow this legislation to fulfill its mission by delivering continued capital flows to opportunity zone communities during this critical transition period. Investors considering this approach should consult with qualified tax advisors and explore investment structures that offer the flexibility needed to execute this timing strategy effectively. Given that most QOFs require 10-year hold commitments, Park View OZ REIT’s publicly traded stock (Symbol: PVOZ) allows the holding period flexibility essential for implementing this bridge strategy—regardless of which QOF investors ultimately choose for their long-term holdings.

Bridge your gains today to capture tomorrow’s Opportunity Zone advantages. Read our Fund Overview to see how Park View OZ makes the transition seamless.

[1] Baker Tilly. Five Key Takeaways on the Opportunity Zones Extender in the One Big Beautiful Bill Act. Retrieved from https://www.bakertilly.com/insights/takeaways-opportunity-zones-one-big-beautiful-bill-act

[2] Taft. Taft Tax Insights: Did You Know That You Can Defer Gain on the Sale of Your Qualified Opportunity Fund Investment by Reinvesting in Another QOF? Retrieved from https://www.tafttaxinsights.com/2025/07/did-you-know-that-you-can-defer-gain-on-the-sale-of-your-qualified-opportunity-fund-investment-by-reinvesting-in-another-qof/

[3] Lowenstein Sandler LLP. Qualified Opportunity Funds: Answers and Questions (Update #1—Tax, Trusts & Estates). Retrieved from https://www.lowenstein.com/news-insights/publications/client-alerts/qualified-opportunity-funds-answers-and-questions-update-1-tax-trusts-estates

Park View OZ REIT: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ REIT is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth for 30 years.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.