How Qualified Opportunity Funds complement Roth IRAs to maximize tax-free retirement savings beyond contribution limits

With Roth IRA contributions capped at $7,000 annually ($8,000 if you’re 50 or older), even disciplined savers may shelter only a fraction of their wealth from future taxation. For investors with capital gains, this creates a critical planning gap: how do you get meaningful assets into tax-free status when contribution limits barely move the needle?

Qualified Opportunity Funds offer a powerful complement to Roth IRAs, one without dollar limits or income restrictions. After starting as a temporary program, QOF tax incentives became a permanent part of the U.S. tax code in July 2025, making them a viable long-term planning tool alongside traditional retirement accounts.

Together, Roth IRAs and QOFs can dramatically expand the portion of your portfolio that grows tax-free, providing greater insight into the amount of savings that will ultimately be accessible given the uncertain tax environment in the decades to come.

How Qualified Opportunity Fund Tax Benefits Work

QOFs provide two distinct tax benefits for investors who roll capital gains into the fund within 180 days of realization:

5-Year Benefit: Deferral Plus Partial Elimination – The initial investment defers your capital gains tax liability for five years from the date of purchase or until you sell the QOF, whichever comes first. If you hold for the full five years, you also eliminate 10% of the original deferred gain. Think of this as a five-year interest-free loan on your tax liability with 10% principal forgiveness.

10-Year Benefit: Complete Tax Elimination – After holding your QOF investment for at least 10 years, you can elect to step up your cost basis to the full market value at the time of sale. This eliminates not just the capital gains tax, but the capital gain income itself.

This distinction matters. When future tax laws target capital gains, as the Net Investment Income Tax did in 2013, there’s simply no gain to tax. Zero multiplied by anything is still zero. This benefit continues for up to 30 years from your initial investment date, effectively future-proofing your wealth against unknown tax regimes decades from now.

Note: The current OZ program only offers deferral until December 31, 2026, with the elimination benefit lasting until 2047. The enhanced benefits described above apply to QOF investments made after January 1, 2027. However, when a QOF is eligible for re-investment and re-deferral for a new 180-day period. This can allow a taxpayer to bridge to the new and enhanced 2027 QOF tax incentives.

Roth IRA vs QOF: Comparing Tax-Free Investment Strategies

Although their tax benefits can be similar, the mechanics are very different:

Contribution Limits

- Roth IRA: $7,000–$8,000 per year based on age

- QOF: No dollar limits; investments can equal any capital gains realized in the past 180 days (whether $10,000 or $10 million)

Income Restrictions

- Roth IRA: Phases out at higher income levels

- QOF: No income restrictions

Tax Treatment

- Roth IRA: Contribute after-tax dollars; growth is tax-free

- QOF: Defer pre-tax capital gains; appreciation of the QOF becomes tax-free after 10 years

Account Flexibility

- Roth IRA: Tax-free account allowing multiple investments and rebalancing

- QOF: Single investment vehicle potentially owning multiple properties within designated opportunity zones (typically commercial real estate)

Early Withdrawal Rules

- Roth IRA: Must reach age 59½ and meet the 5-year rule to avoid penalties

- QOF: Can be sold anytime without penalty; 10-year hold required for the tax elimination benefit

Generational Wealth Transfer

- Roth IRA: Lifetime benefit, but beneficiaries typically must liquidate within 10 years

- QOF: 30-year benefit; beneficiary “steps into the shoes” of the decedent (if purchased 15 years before death, beneficiary has 15 years remaining of tax-free growth)

The 30-Year Tax-Free Compounding Advantage

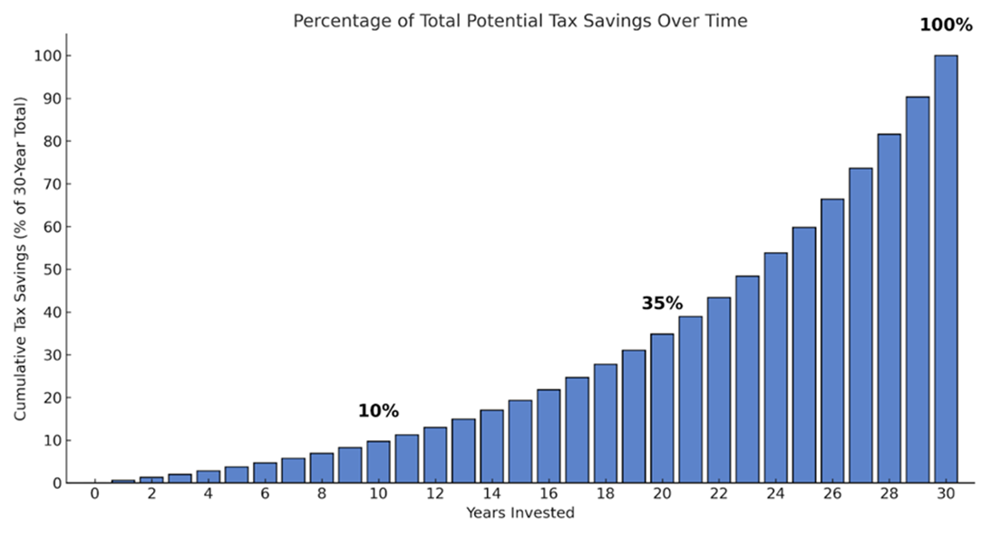

Consider this: assuming a 10% growth rate and a 23.8% combined tax rate (20% capital gains + 3.8% NIIT):

- Year 10: Only about 10% of potential tax savings are realized

- Year 20: Roughly one-third of tax savings are captured

- Year 30: 100% of tax savings are achieved—ten times the benefit of stopping at year 10

Chart: Percentage of total potential tax savings realized over time with a QOF investment, assuming a 10% growth rate and a 23.8% tax rate (20% capital gains + 3.8% NIIT).

To maximize long-term tax-free growth, look for QOFs structured to:

- Emphasize buy-and-hold strategies to minimize taxable events

- Offset ongoing income with interest deductions and depreciation

- Enable investor control over holding periods without forced liquidations

- Avoid carried interest fees that incentivize property sales (which trigger taxable events at the fund level, defeating the tax benefit)

Why Tax-Free Retirement Planning Matters

It’s impossible to predict what tax rates will be or what new taxes will be created in the coming decades. By increasing the proportion of your wealth held in truly tax-free vehicles, you gain something invaluable: better clarity about your available savings.

Roth IRAs provide this certainty for a diversified portfolio. QOFs extend this to much larger dollar amounts, potentially achieving in a single transaction what would otherwise take decades of Roth contributions.

For investors with capital gains, using QOF tax incentives can be a robust tool for creating a tax-efficient portfolio, giving you more confidence in your long-term savings.

Conclusion: The One-Two Punch

Roth IRAs and QOFs are complementary tools, not competing strategies. Roth IRAs offer flexibility and lifetime benefits for regular savings. QOFs provide unlimited capacity for capital gains with three decades of tax-free compounding potential.

Together, they form a powerful combination for tax-free financial planning—each addressing limitations the other cannot.

QOF Investment Checklist:

Finding Funds Built for Long-Term Tax-Free Growth

Unlock the potential for Roth IRA-like tax-free growth through Opportunity Zone investing. Read our Park View OZ Fund Overview to see how.

Park View OZ REIT: The Streamlined Approach to QOF Investing

Unique Public Access: Park View OZ REIT is the only Qualified Opportunity Fund with publicly traded shares (trading symbol: PVOZ).

Flexible Entry Options: Begin with as little as one share on the open market or $10,000 through our subscription agreement.

Investment Timeline Freedom: Exit at your discretion without penalty. With no planned 10-year liquidation, maximize potential tax-free growth for 30 years.

Simplified Tax Reporting: Avoid the complexity and delays of partnership K-1 tax forms.

Open to All Investors: No accreditation requirements to participate.

Convenient Purchasing Methods: Buy shares through your existing brokerage account or directly via our website’s electronic subscription agreement.

Are you ready to see how QOFs can benefit you?

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.