Many taxpayers and even some financial advisors are not aware of the numerous ways they can be used to create tax-efficient financial results. Investors can defer tax payments on prior capital gains if they re-invest the gains in real estate or business development in economically distressed areas known as “Opportunity Zones.”

To help mitigate economic disparity, Congress created Qualified Opportunity Funds (QOFs) as part of the Tax Cuts and Jobs Act (TCJA) of 2017. The TCJA narrowed the use of Section 1031 exchanges, but by creating QOFs it greatly broadened the types of capital gains eligible for tax incentives. Now a capital gain from selling a stock, a business, or just about anything else you can think of, creates the opportunity to enjoy significant tax incentives.

A group of bipartisan Senators and Representatives are expected to reintroduce The Opportunity Zones Transparency, Extension, and Improvement Act. The legislation is expected to enhance the community impact reporting requirements for QOFs and extend and enhance the potential tax incentives for current and future QOF investors. If enacted, this legislation would be the first substantial update to the Opportunity Zone statute since it was enacted in 2017.

To qualify for the QOF tax incentive, investors must reinvest a capital gain into a QOF within 180 days of realizing the gain. QOFs, in turn, reinvest the capital into any of the more than 8,700 designated low-income Opportunity Zones nationally, designed to spur economic development and job creation in distressed communities. Investors earn tax advantages and benefits by investing in new construction or making “substantial improvements” to an existing property within 30 months.

Opportunity Zones themselves are defined by census tracts typically with populations of two to eight thousand people and highly variable economic potential. (Certain types of business cannot be included in QOFs, even if they reside within Opportunity Zones, such as golf courses, country clubs, liquor stores, and racetracks or other facilities used for gambling.)

QOF tax incentives are generous and well worth pursuing. Pundits often cite an after-tax advantage of 3% based on a market return of 7% to 8% and a 10-year holding period. The math works out to an extra 40% return (3%/7.5%=40%) to investors, not just one time but year after year. Tax-free compound growth is a wonderful thing!

The following are the tax incentives of QOFs:

The following are 12 ways to use QOFs to enhance tax-efficient financial plans:

Tax payers with capital gains in collectible assets, such as art, precious metals (even ETFs invested in collectibles such as gold ETFs, wine etc., should be particularly motivated to utilize QOF tax-incentives. The same legislation that created QOFs eliminated the eligibility of collectibles to claim 1031 (like-kind exchange) tax treatment. Before the Tax Cuts and Jobs Act a collector could sell an appreciated asset and defer the tax by executing a 1031 exchange into a new like-kind asset. Now when a collector has a capital gain, they cannot defer the tax through a “like-kind exchange,” and they also face a higher marginal capital gain tax rate of 28% versus 20% for most asset classes. They can, however, defer the tax through a QOF investment.

For a taxpayer to claim QOF benefits they have to reinvest an amount equal to or less than capital gains they have taken in the last 180 days. Fortunately, unlike 1031 exchanges, QOF investments do not need to invest the same funds received from the capital gain – there is no cash tracing requirement, and this can be very helpful for an investor with liquidity. If an investor would like to benefit from QOF tax incentives but currently only has cash that is not eligible, they could trigger a gain elsewhere in their portfolio. For example, an investor could sell a stock with a low-cost basis and buy it back immediately. Their money will now be eligible for a QOF tax incentive for the next 180 days – up to the amount of the triggered capital gain. Additionally, they will have eliminated the unrealized capital gain liability from their stock position. This transaction would not be subject to wash sale rules because those apply to harvesting tax losses, not gains.

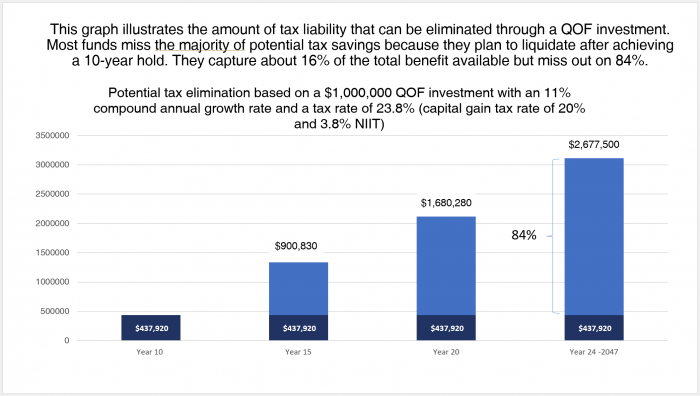

The biggest tax benefit offered by a QOF investment is the potential for tax-free compound growth. Once an investor achieves a 10-year hold in the QOF they can elect to step-up their cost basis 100%, eliminating any capital gain liability. This benefit is often thought of as a 10-year benefit, but that is just the beginning because the benefit does not expire until 2047 – another 24 years. Compound growth curves accelerate in the outer years, and this is certainly true for QOFs. Using typical market returns, roughly 84% of tax benefits are derived after year 10. Unfortunately, many QOFs have planned liquidations shortly after the 10th year, ending the tax-free compound growth prematurely. If you are lucky enough not to have to withdraw from your investment, then the option to keep this powerful wealth-creating tax incentive rolling can be very beneficial.

Exhibit 1: Amount of Tax Liability That Can be Eliminated Through a QOF Investment

As seen in Thomson Reuters’ journal Estate Planning: https://www.thomsonreuters.com/

Materials provided by Park View OZ REIT or our affiliates have been prepared for informational purposes only and are not intended to provide or be relied on for tax, legal, or financial advice. You should consult your own tax and legal advisors before engaging in any transaction.