Qualified Opportunity Fund (QOF) tax incentives are a powerful financial planning tool. The U.S. Treasury is offering investors with recent capital gains significant tax benefits to reinvest their gains into low-income areas through QOFs, with the important goal of creating jobs and promoting economic equality. However, the design of the first generation of funds severely limited both their utility for financial planning purposes and the audience of investors who could participate in them. Now, a second generation of funds offers the accessibility and flexibility financial planners need to fulfill this tax incentive’s potential as a must have financial planning tool.

When the opportunity zone legislation was signed into law as part of the Tax Cuts and Jobs Act (TCJA) [1] at the end of 2017, tax practitioners began preparing for what many expected to be a flood of opportunity zone related business. This expectation was reasonable given that knowledgeable observers, including the EIG Group, [2] calculate that on a 7% or 8% annual return, QOF benefits would add the aftertax equivalent of 3% annually. That means that a qualifying QOF investment is earning roughly 40% (3%/7.5%=40%) more for the investor year after year.

Financial advisors work in a highly competitive industry, and they truly add value only if they can improve investors’ returns above

what is available from low-cost index investments. As a result, investment professionals will fight for even an additional 0.25% return for their clients. This makes the QOF’s potential to increase after-tax returns by a full 3.00% highly attractive.

Additionally, because almost all investors will have QOF-qualifying capital gains over time, this incentive can be broadly applicable to

the investing public.

QOFs offer a combination of a potentially significant boost to after-tax investment returns, applicability to most investment portfolios, and a positive social impact. This should have been enough to drive broad investor participation. Unfortunately, for reasons this article will illuminate, the first wave of QOFs appealed only to a narrow portion of the overall investment community.

The following is a quick review of the two tax incentives available on realized capital gains reinvested within 180 days into a QOF:

Billions of dollars have been invested through QOFs but to date these funds are largely coming from a relatively small group of wealthy

investors. The surprisingly disinterested response among the broader investment community to QOFs has nothing to do with the benefits

offered, which are very generous. The problem lies in the structure used by first-generation QOFs.

These funds were patterned after traditional commercial real estate partnerships. Historically, investors in these funds have committed their capital for three to seven years, allowing time for the project to be developed, stabilized, and perhaps enjoy a few good high-depreciation years before the fund is liquidated. The model works well for commercial real estate projects. Most QOFs use this same partnership model but modify it to attain the 10-year QOF holding period for capital gain elimination followed by a planned liquidation soon thereafter.

Many financial professionals and investors believe that attaining QOF tax incentives requires a 10-year capital commitment and that only the wealthy are making these investments. This is a pretty accurate picture of the requirements most current QOFs have today. It is important to realize that this is a result of the way QOF sponsors have structured the funds. The QOF rules themselves do not have

restrictions that would exclude the average investor from participation. However, because the first generation of QOFs were set up as partnerships, investor participation heavily skewed towards wealthy investors. The QOF rules also do not have any provision that would inhibit investor liquidity.

The capital gain deferral benefit is available right away. The rules encourage long-term investment by having a 10-year holding period to achieve the capital gain elimination benefit, but there is no penalty for only using the deferral benefit and exiting the investment when you choose.

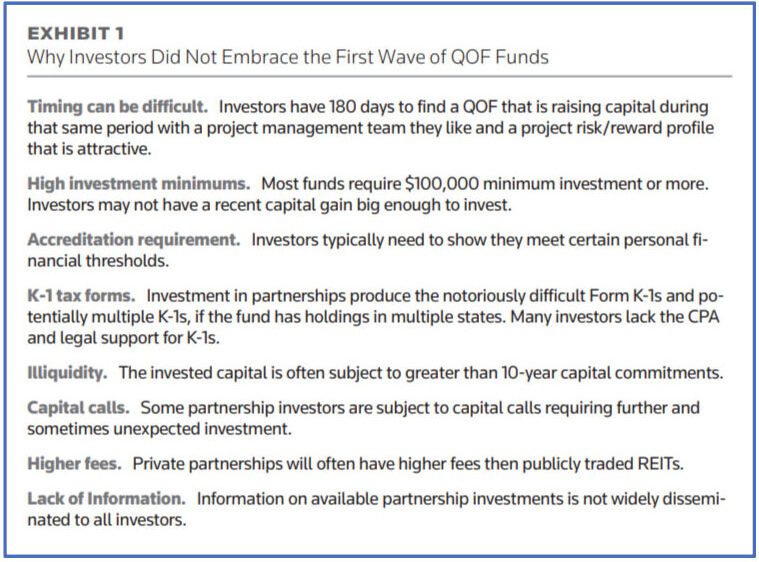

Exhibit 1 shows why the broader investment community has not embraced the first generation of QOFs and their partnership structure despite lavish tax incentives and a chance to make a positive social impact.

As Exhibit 1 highlights, there are many reasons why most investors shy away from partnership investing. You will notice that these access problems become less burdensome if you are wealthy. The wealthiest investors are willing to lock up large sums of money for ten-plus years, they have the legal and CPA support to deal with K1s, accreditation requirements are not an issue, and capital calls will not break them.

For investors trying to access QOF tax incentives, it gets worse because QOFs add a couple of unique hurdles to the mix. The first is timing; you must find a suitable QOF within 180 days of realizing your capital gain. Finding a fund with attractive underlying investments with the correct management and finding them during their capital raising window can be tricky. Second, the high investment minimums become more daunting because only recent capital gains get QOF tax treatment. If you have a capital gain of $50,000, it may be well worth mitigating the tax burden through a QOF investment, but finding a fund with a low enough minimum could be another sticking

point.

Fortunately, creating broad investor access to private commercial real estate deals is a problem that has been solved before.

It was evident by the 1950s that a great deal of wealth was being created in commercial real estate. It was also clear that partnerships

dominated access to these investments because of their tax-efficient pass-through status. For essentially the same reasons as today, only a small percentage of the investing public were willing and able to invest in these partnerships.

In 1960 Congress set out to democratize investment in commercial real estate by creating real estate investment trusts (REITs). The bill was the last bill sponsored by Senator John F. Kennedy before he became President. It allowed all investors to participate in commercial real estate through the purchase of traditional shares of stock. This new vehicle worked because it had the shareholder-friendly benefits of a corporation but would be taxed as if they were in a partnership, i.e., no double taxation on earnings paid out to investors.

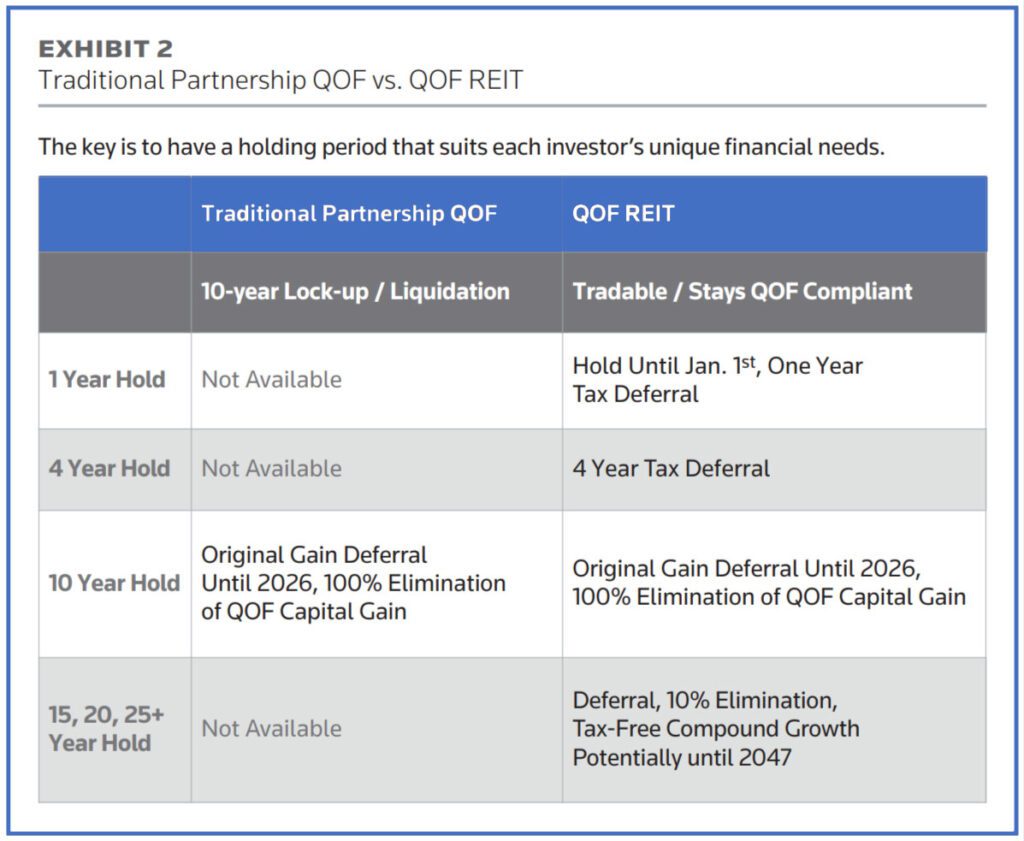

QOFs structured as public REITs can deliver investors the accessibility and flexibility needed to unleash the full potential of this potent tax incentive. This solution not only eliminates the obstacles inherent in partnership investments, but it gives investors liquidity and allows investors to control their own holding periods. The REIT structure allows the fund to stay compliant while investors can enter or exit on a timetable that best suits their needs, not the fund’s needs.

Planned liquidation of the fund after ten years does not make sense for investors who want to maximize QOF benefits. Why liquidate a fund and end tax-free growth that could continue for many years to come? If you do not need the money, let the tax-free compound growth keep rolling.

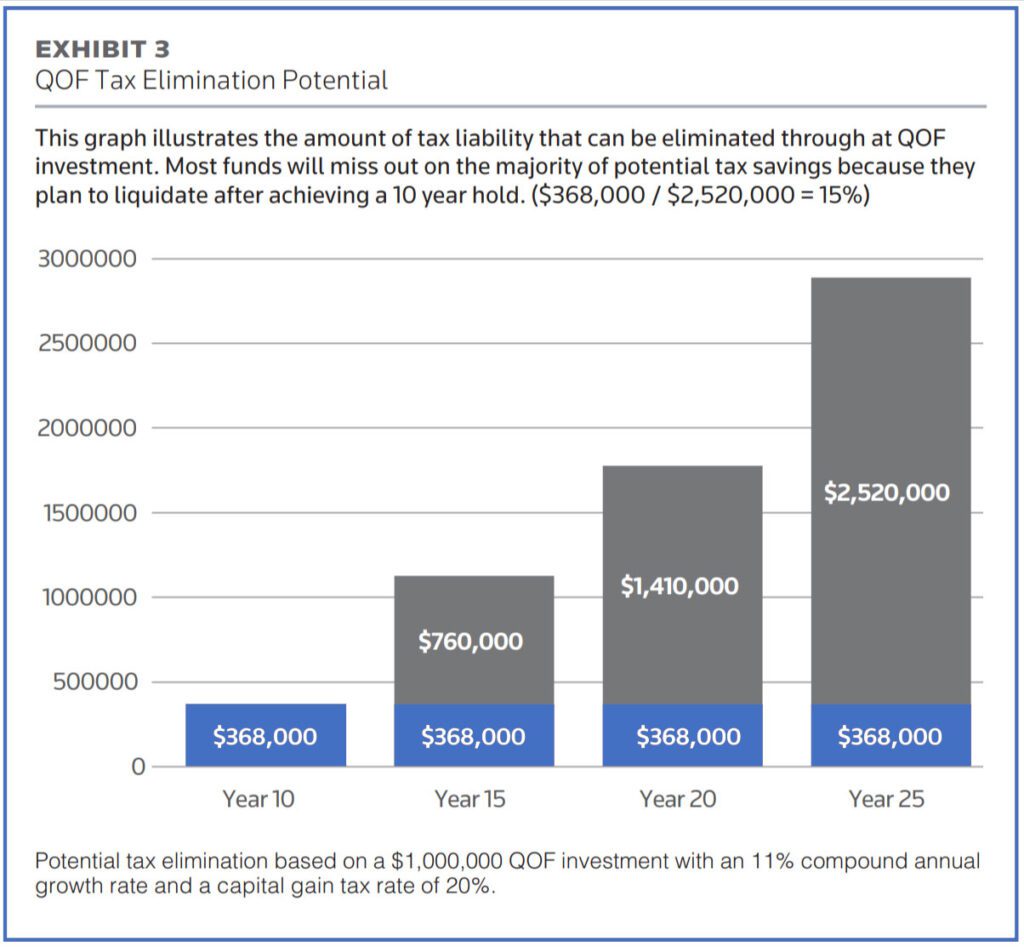

It is the second QOF tax incentive, 100% capital gain elimination, that delivers the real wealth creation magic. We have all seen compound growth charts and marveled at the math and its ability to create wealth. One thing all compound growth charts share is that the greatest portion of wealth creation happens in the latter part of the chart. Allowing a long runway of compounding creates bigger waves of wealth.

QOFs offer not only compound growth but tax-free compound growth, aka: the eighth wonder of the wealth management world!

Joseph Luna, a tax attorney, and opportunity zone compliance specialist, recently wrote a blog post describing the QOF REIT structure as creating “unrivaled tax savings for investors.” [3] Luna points out that REIT dividends also qualify for the Qualified Business Income (QBI) deduction (Section 199A), reducing taxable income payout as dividends by 20%. This reduces the investors’ highest tax rate income, likely reducing their tax bill by more than 20%. REITs, by definition, must pay out at least 90% of their taxable income as dividends. This tax reduction, in addition to the QOF tax incentives, creates a highly tax efficient structure.

If you are fortunate enough to have recently realized a $10,000, $25,000, or even a $50,000 capital gain, you may find that your options for deferring the tax liability are surprisingly limited. One of the great features of QOFs is their ability to defer and partially eliminate capital gains from virtually any source. Unfortunately, traditional QOF partnerships often require minimum investments significantly higher than these capital gains. If a fund did accept the investment, the illiquidity of capital commitment terms, the difficulty of K-1 tax forms, potential multiple K-1s if the fund has investments in multiple states, and the potential for future capital calls would all have to be weighed.

Even for accredited investors, the ability to defer a tax liability through a QOF REIT stock purchase will often be the only practical option for small and midsized capital gains.

QOFs structured as REITs with freely tradable shares of stock can add value for investors who want to defer and potentially eliminate capital gain liabilities for the short or long term. For example, investors have a capital gain, but they know they will need the capital in a few years when their child begins college. The taxpayers can defer the capital gain by investing in a QOF, keeping their capital working for them longer, and hopefully earning returns that will help offset tuition costs.

Investors can defer a capital gain liability by just a year by holding the QOF until January 1, but for our example, let us say that the child’s tuition is due three years after the gain is realized. When the tuition payments begin, the investor can sell off just the amount of the QOF shares they need to cover the first tuition payment. This will end the deferral period on the portion of the QOF which was sold, but the deferral will continue for the remaining QOF investment. The investor can continue to pay tuition bills from the QOF as they come due.

The deferral benefit for the investor will end on 12/31/2026, and the original capital gain tax will need to be paid in the spring of 2027. The character of the gain will remain constant (short term vs. long term), but the gain will be taxed at 2026 rates.

Suppose there is a pleasant surprise, and the child receives a full scholarship. In that case, the investors can change their plans, continue to hold the QOF, and enjoy the biggest QOF benefit — the total elimination of capital gain on the QOF once the 10-year holding period is achieved. The investors can now enjoy tax-free compound growth of the QOF via a 100% step-up in cost basis until they sell their shares, or the benefit expires in 2047.

It is important for investors and their advisors to understand how long a QOF’s fund manager plans to stay QOF compliant. Many QOFs have planned liquidation events shortly after the 10-year holding period is achieved. This unfortunately ends the tax incentives for the investor. To optimize a tax-efficient QOF investment plan it is crucial to choose a QOF that will to remain QOF compliant throughout the more than 25-year life of the tax-free compound growth benefit. As Exhibit 3 illustrates, investors who choose funds with a planned liquidation event after a 10-year hold will miss out on roughly 85% of the potential tax elimination. No one knows what the future will bring 10 years from now, but for those lucky enough to not need the money allowing the investment to grow tax-free is a wonderful wealth creation option to have available.

Just as REITs opened commercial real estate investments to the general investing public more than 60 years ago, the structuring of QOFs as REITs with tradable shares of stock will open QOF benefits to a much broader investor base. It will also pour much-needed capital into communities that benefit most from the job creation that capital investment brings.

It is likely investors, CPAs, and other financial advisors will increasingly take advantage of the versatility, convenience, and better financial outcomes made possible by the QOF REIT structure. To summarize, a QOF REIT with tradable shares of stock delivers two main

advantages over the traditional partnership QOF:

Capital being invested in QOFs structured as REITs is still a small percentage of the overall QOF investment, but it is accelerating. This second wave of QOFs may hold the key to unlocking the financial potential of qualified opportunity funds for both investors and the communities they are meant to serve.

[1] P.L. 115-97, 12/22/2017.

[2] https://eig.org/wp-content/uploads/2018/01/Tax-Benefits-of-Investing-in-OpportunityZones.pdf.

[3] https://ozinvested.com/oz-blogs/f/reits-andopportunity-zones.

As seen in Thomson Reuters’ journal Estate Planning: https://www.thomsonreuters.com/