Transform Tax Savings into Wealth-Building Opportunities with QOFs

Download a copy of our informative white paper and discover how you can defer or even eliminate capital gains taxes while strategizing for future wealth growth.

Download White Paper

Transform Tax Savings into Wealth-Building Opportunities with QOFs

Download a copy of our informative white paper and discover how you can defer or even eliminate capital gains taxes while strategizing for future wealth growth.

Download White Paper

Unlimited Contribution Potential

Ever wish you could have more tax-free funds working for you in your Roth IRA? Tax-free compound growth is a great way to build wealth and is sometimes referred to as “the eighth wonder of the investing world.” The key is to maintain a long-term focus and invest as much as possible, as early as you can. Because the Roth tax savings are significant, the government tries to restrict access by imposing income and annual contribution limits. However, the soon-to-expire Tax Cuts and Jobs Act (TCJA) created a new way to enjoy tax-free compound growth without contribution caps or income restrictions: Qualified Opportunity Funds (QOFs).

How QOFs Work

QOFs offer tax-free capital appreciation until 2047 without the dollar contribution limits that slow asset accumulation in Roth accounts. Once an investor realizes a capital gain they have 180 days to invest in a QOF up to the amount of the gain. They can eliminate all capital gain liability by staying invested in the QOF for 10 years. QOFs also offer an additional deferral benefit and no penalties for early withdrawal. While these benefits may expire soon, investors who take advantage now can enjoy the potential of more than two decades of tax-free compound growth through 2047.

A capital gains liability can be deferred by reinvesting the capital gain portion of your sales proceeds in a Qualified Opportunity Fund within 180 days of realizing the gain. There is no dollar limit on how much gain can be deferred.

Although only proceeds from recent capital gains can qualify for tax deferral and possible elimination incentives, Park View OZ REIT is a mixed fund that allows you to invest any type of capital you choose.

About Park View OZ REIT

Park View OZ REIT (stock symbol: PVOZ) is the only Qualified Opportunity Fund (QOF) to offer the convenience and accessibility of public stock ownership. We give all investors access to powerful opportunity zone tax incentives and provide the flexibility needed to create a myriad of tax-efficient wealth management strategies. The proceeds of this offering will be invested in opportunity zone properties throughout the U.S. Our unique structure is highly advantageous for investors with capital gains, facilitating compound tax-efficient growth.

Why Choose Us

We offer the powerful tax benefits of a qualified opportunity fund with the flexibility and accessibility of publicly traded shares.

For investors we:

- Removed any minimum and maximum holding period requirements. The ability to control your holding period is crucial for creating a tailored financial plan.

- Eliminated investor accreditation requirements so anyone can participate.

- Kept fees low.

- Eliminated high investment minimums.

- Provide the transparency of a publicly reporting fund.

Already maxed out your annual Roth IRA contribution? Enjoy tax-free growth without investment maximums or income restrictions with Park View OZ REIT.

Are you ready to see if Park View OZ REIT can enhance your financial and tax planning strategy?

Q&A

Read the Q&A below to learn how Park View OZ REIT uniquely enables the creation of superior tax strategies.

What are the short-term benefits of a QOF?

The order and timing capital gains and losses are realized matters for tax planning.

- Deferment of the original capital gains taxes until the QOF is sold or through December 31, 2026. We believe there is a strong possibility that Congress may choose to extend this benefit beyond 2026.

- Control over the holding period enables our investors to implement a variety of tax-saving strategies.

See our strategies document for more information.

What are the long-term benefits of a QOF?

Roth-like benefits without income or annual contribution restrictions.

- Elimination of all capital gains taxes, including the 3.8% NIIT, via a 100% step up in cost basis, once a 10-year hold is achieved.

- Unlike most QOFs, we don’t implement 10-year planned liquidations of the fund.

- Our investors enjoy the potential for Roth IRA-like tax-free compound growth until the incentive sunsets in 2047, which is critical to building wealth.

What is the advantage of eliminating maximum holding periods?

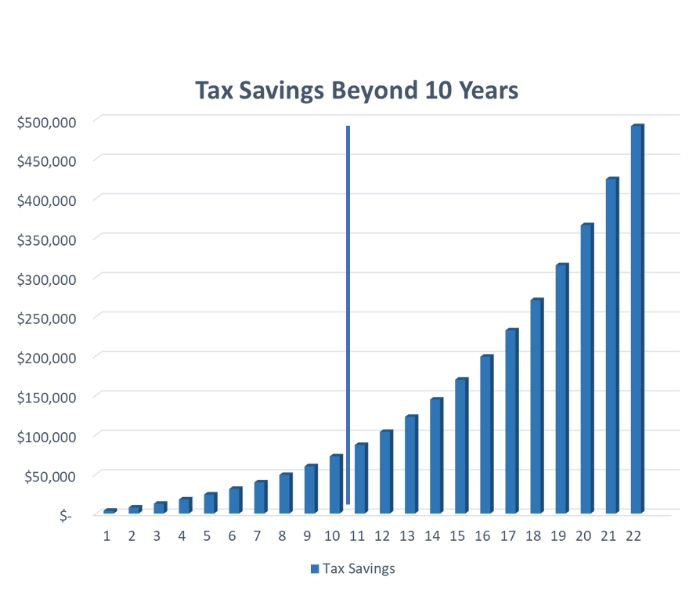

The biggest tax benefit offered by a QOF investment is the potential for tax-free compound growth (aka: The eighth wonder of the financial world). Once an investor achieves a 10-year hold in the QOF they can elect to step-up their cost basis 100%, eliminating any capital gain liability. This benefit is often thought of as a 10-year benefit, but that is just the beginning because the benefit does not expire until 2047 – another 23 years! Because compound growth curves accelerate in the outer years, roughly 84% of tax benefits are derived after year 10. This is a big advantage enjoyed by Park View OZ REIT investors. Unfortunately, a large majority of QOFs have planned liquidations shortly after the 10th year, ending the tax-free compound growth prematurely and forfeiting a huge potential tax benefit.

What is the advantage of eliminating investor accreditation requirements?

It makes accessing QOF tax incentives significantly easier. Because Park View OZ REIT is a public company, we have no accreditation requirements and anyone can invest in our shares. By contrast, almost all QOFs still have accreditation requirements which prohibits most of the investing public from participating. Additionally, even if you meet the accreditation requirements, turning over financial records to prove it can be a hassle and feel invasive. We believe that removing the accreditation requirement works well for our shareholders.

How do Park View OZ REIT's fees compare to other qualified opportunity funds?

We always aim to be the lowest cost option for investors. Most of our competitors are partnerships which tend to have higher fees than a REIT. For example, most qualified opportunity funds charge a management fee of roughly between 1% to 2% with and average of 1.5%. Our management fee is .75%, so half the average funds fee.

Why did Park View OZ REIT feel it was important to keep minimum investment requirements low?

Many QOFs have investment minimums of $100,000 or more. We knew that investors often had capital gains that were not big enough to qualify for the typical QOF minimum investment. We give these investors a practical solution by having a low subscription agreement minimum of $10,000. Investors may also buy as little as one share of our stock in the public markets. The tax benefits are the same regardless of where the shares were bought.

Why is transparency important for investors?

The ability to understand and track how an investment is performing is crucial to making sound financial planning decisions. We strive to provide our investors transparency in several ways. First, we emphasize providing strong direct investor communications by answering any questions quickly and accurately. Investors can also get information about the fund from several sources online with the most information located on Park View OZ REIT’s own website. Additionally, because we are a public company all of our import documents including our periodic earnings reports, annually audited financials and our offering documents are available on the securities and exchange commission’s website through their EDGAR system.

What is a qualified opportunity fund (QOF)?

A qualified opportunity fund is an investment vehicle that is organized for the purpose of investing in qualified opportunity zone properties. The IRS keeps track of investment opportunity zone tax incentive compliance through QOFs. A QOF needs to have at least 90% of its assets invested in tangible qualified opportunity zone properties to stay compliant.

What are the two tax incentives offered by a QOF?

1. Almost any type of capital gains liability can be deferred until the QOF is sold or December 31, 2026.

2. After holding a qualifying investment in the QOF for 10 years, any capital gain achieved by the QOF can be eliminated.

The second benefit is by far the most powerful. It allows investors to compound growth tax-free until you sell the QOF or 2047.

Who is eligible for QOF tax incentives?

Anyone who owes a capital gains liability to the U.S. government is eligible. In most cases, once the gain is realized, it must be invested into a QOF within 180 days, but there are exceptions and extensions to this rule. Importantly, unlike 1031 exchanges, you only need to invest the gain into the QOF to qualify for the tax benefit. The principal portion of your proceeds is free for any use.

What is the purpose of opportunity zone tax incentives?

The purpose of opportunity zones is to create a positive social impact by spurring economic growth and job creation in low-income communities designated as opportunity zones. It offers significant tax incentives for participating investors. States nominate communities for the designation, and the U.S. Department of the Treasury certifies that nomination. Opportunity Zones were created under the 2017 Tax Cuts and Jobs Act. There are more than 8700 designated opportunity zones located across all 50 states.

How can shares of Park View OZ REIT be purchased?

There are two ways shares can be purchased with Park View OZ REIT:

- Shares can be bought through our subscription agreement, which offers a fixed price of $100 a share.

- They may be purchased under the stock symbol “PVOZ” through a brokerage account at a price that fluctuates with the market.

The shares of stock and tax benefits are identical regardless of how they are acquired. We recommend you review our offering circular before making a purchase.

Why did Park View OZ REIT choose to go through the rigorous process of providing publicly traded shares of stock?

We believe a QOF with public stock significantly widens accessibility to QOF benefits. Additionally, the flexibility of public stock also opens up a myriad of financial planning strategies. Everyone’s financial needs are unique. Some investors may only want to defer their capital gains for a year, others may want to hold on for tax-free compound growth until the benefit expires in 2047, and still others may be uncertain of their future financial needs and want to keep their options open. We strive to provide our investors with the best possible opportunities.

Have more questions? We're here to help.

Schedule a free consultation to discuss how a QOF can be the right investment for you.

These pages are prepared for informational purposes only and are not offered as legal, tax, or investment advice. All content provided is of a general nature and does not address the particular circumstance of any particular individual or entity. We encourage you to seek guidance regarding your individual financial needs from legal, tax or investment professionals. Investments, including our shares of stock, have inherent risks including the risk of principal loss.

These pages are prepared for informational purposes only and are not offered as legal, tax, or investment advice. All content provided is of a general nature and does not address the particular circumstance of any particular individual or entity. We encourage you to seek guidance regarding your individual financial needs from legal, tax or investment professionals. Investments, including our shares of stock, have inherent risks including the risk of principal loss.